Stop Loss

此内容尚不支持你的语言。

What is a Stop-Loss order/position?

A Stop-Loss is an order placed to sell an asset when it reaches a certain price. It’s a risk management tool primarily used to limit your losses if the price of a coin moves in a negative direction. When the coin’s price falls to the stop-loss level, the stop-loss order becomes a market order and is executed at the best available price.

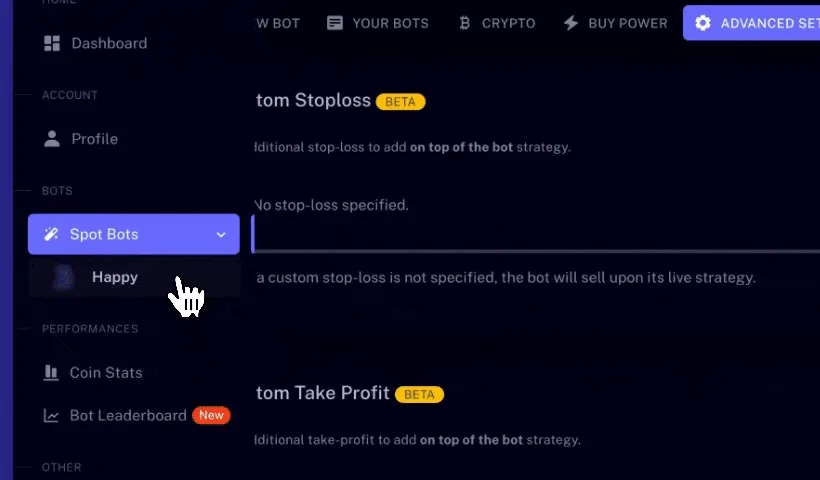

In DipSway, you can set a custom stop-loss as a percentage on top of the bot(s) behaviour. Every time the bot performes a new Buy Order the bot places a stop-loss order with the percentage you set.

DipSway’s AI bot Stop-Loss

How it works

DipSway’s AI spot bot allows you to set a custom Stop-Loss. The stop-loss you set will synergize with your bot behaviour, meaning the bot’s behaviour prevales your set stop-loss. However, the spot bot tends to hold more often than sell at a loss so it’s recommended to set a personal stop-loss that will act as a safety net by minimizing losses in case of drastic market downtrends.

Setup a Stop-Loss on your bot

How to set the optimal Stop Loss

As always, there isn’t a secret formula for the perfect stop-loss. Many factors, such as:

- coin volatility

- position size

- your trading experience

- your risk tolerance

should be considered when setting the DipSway’s custom stop-loss.

Example

Safety net:

You set a 30% stop-loss. When the bot decides to place a Buy Order, the bot will open a Stop-Loss order as well at -30%.

If the position you bought drops to -30%, the stop-loss order will trigger, closing the position at a loss. 👍🏼